If you’re an 18 year old student who is just getting started with their business, you’re probably wondering if Facebook ads are tax deductible. The answer is YES! Facebook ads are a great way to promote your business and any money you spend on them can be deducted from your taxes. This article will explain how you can make the most of your Facebook ads and take advantage of the tax deductions available.

What Can Businesses Deduct From Facebook Ads?

Businesses are always looking for ways to save money and take advantage of tax deductions. Facebook ads can be a great way to market your business and reach new customers, but did you know that your Facebook ad costs can be tax deductible? That’s right! You can deduct the cost of your Facebook ads as a business expense. This means that you can get back some of the money you spent on ads, which can help you save money and have more money to spend on other aspects of your business. So if you are using Facebook ads to promote your business, make sure to keep track of your expenses so you can get the full tax deduction.

Tax Benefits of Facebook Ads for Businesses

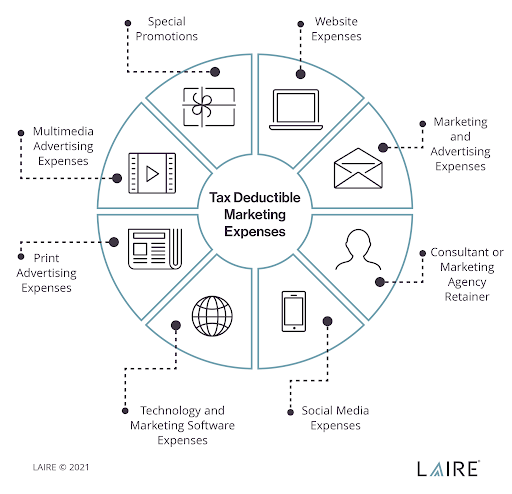

As a business owner, there are lots of tax benefits to using Facebook Ads. Not only are you able to deduct the costs of the ads on your taxes, but you can also deduct the costs of any tools associated with running the ads. This includes any technology such as software or hardware used to track and manage campaigns. Additionally, any fees associated with managing the campaigns can be deducted as well. This can add up to a sizable tax deduction, making Facebook Ads a great investment for businesses.

How to Claim Tax Deductions for Facebook Ads

If you’re a business owner, you’ve probably asked yourself this question: are Facebook Ads tax deductible? The answer is yes! To claim tax deductions for Facebook Ads, it’s important to track your ad spend and keep records of the ads you’ve run. You’ll need to provide these documents when filing your taxes. Additionally, make sure to keep a copy of your invoices from Facebook and other online advertising platforms. Finally, be sure to consult a tax professional to ensure you’re taking advantage of all the deductions available to you.

Understanding the Tax Implications of Facebook Ads

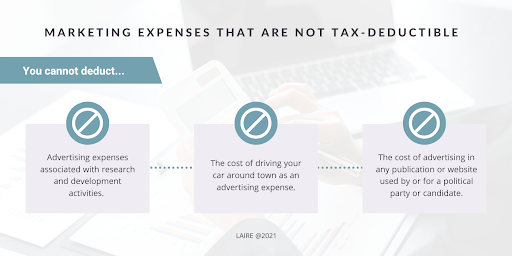

Understanding the tax implications of Facebook Ads can be a bit tricky. It’s important to keep in mind that the IRS considers Facebook Ads to be a form of advertising expense and therefore may be tax deductible. However, it’s important to note that the rules vary based on your individual situation. Depending on the type of business you are running, the deductions may be different. For example, if you’re a sole proprietor, you may be able to deduct the full cost of the ad, but if you’re a corporation, you may need to allocate the costs between capital and expenses depending on the type of ad. Additionally, if you’re running a charity, there may be other deductions available to you. Ultimately, it’s important to talk to a CPA or tax expert to understand the exact implications of your Facebook Ad campaign.

Tips for Maximizing Tax Savings with Facebook Ads

As a student, I’m always looking for ways to save money and maximize tax savings. Facebook Ads are a great way to do just that. Here are some tips for maximizing tax savings with Facebook Ads: First, make sure you’re tracking your Facebook Ads spend. This will help you keep track of your total ad spend for tax deductions. Second, make sure you are tracking all of your Facebook Ads related expenses, like advertising fees, software subscriptions, and other costs related to your campaign. Finally, make sure to consult a tax expert if you have any questions about deducting Facebook Ads related costs. With these tips, you can maximize your tax savings and make the most of your Facebook Ads budget!

GIPHY App Key not set. Please check settings