If you’re an 18 year old student looking to get rich, look no further than Warren Buffett, one of the world’s most successful investors. Warren Buffett’s success story is an inspiring one, and it’s no surprise that he’s become one of the wealthiest people in the world. In this article, we’ll explore how Warren Buffett made his money and how you can use his strategies to make your own fortune. With his knowledge and experience, Warren Buffett has become an icon of success and a role model for aspiring entrepreneurs. So, if you’re ready to learn how Warren Buffett got rich, read on!

Early Life and Investing Strategies of Warren Buffett

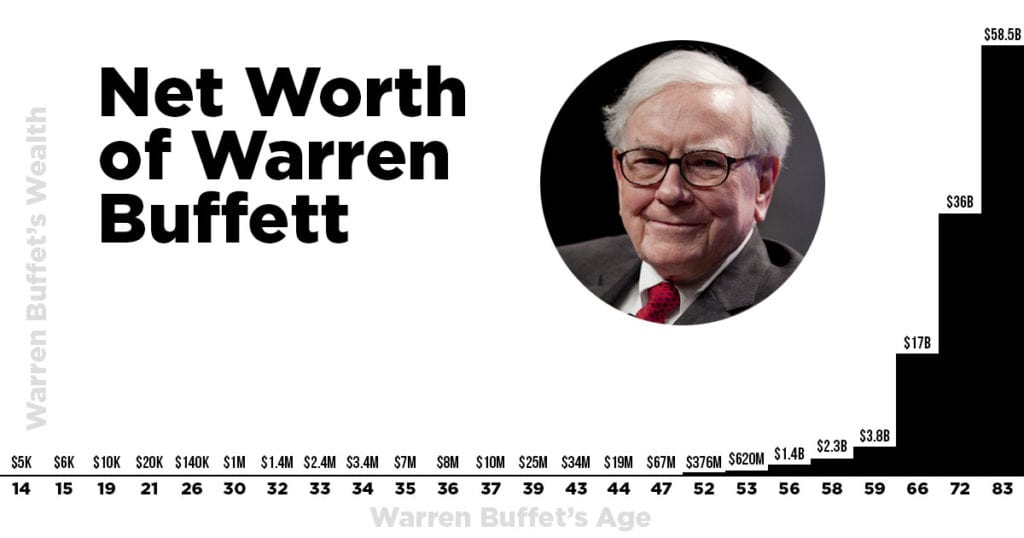

Warren Buffett is an American investor and philanthropist, with a net worth of over $89 billion. Buffett was born in 1930 in Omaha, Nebraska, and as a child, he was already investing. His early investments included buying stocks in textile and food companies. Buffett’s investing strategies also included buying shares in companies with strong fundamentals and potential for growth, and he was a pioneer of value investing. He also believed in diversifying his investments, which allowed him to minimize risk and maximize returns. He has since become a legendary investor, and is seen as one of the most successful investors in history.

Warren Buffett’s Take on Risk and Diversification

Warren Buffett is known for his ability to take calculated risks, and diversification has been key in his success. He believes that diversifying your investments is important for long-term success, as it reduces your exposure to individual risks. To achieve this, Buffett recommends that you “invest in a variety of assets, and not put all your eggs in one basket”. He also recommends that you purchase assets that you understand and that you’re comfortable with. By taking a diversified approach to investing, you can help protect yourself from market volatility and maximize your return on investment.

Warren Buffett’s Long-Term Investment Approach

Warren Buffett’s long-term investment approach is widely recognized as the key to his success. By taking a long-term view, he has been able to take advantage of the stock market’s natural ups and downs and capitalize on potential opportunities. He is a firm believer and advocate of buy-and-hold investing and usually does not buy or sell stocks quickly. Instead, he prefers to wait for the right opportunity and then waits for the market to come to him. His long-term approach has allowed him to create a diversified portfolio that continues to grow over time and provides him with consistent returns.

How Warren Buffett Builds Wealth Through Acquisitions

Warren Buffett’s wealth has been built through his investments in acquisitions. He is known for his strategy of buying undervalued companies and holding them for long-term growth. He has been able to acquire companies at bargain prices and nurture them until they reach their full potential. By investing in low-risk investments and taking advantage of market opportunities, Buffett has been able to amass a fortune. His ability to spot value and take risks when others are afraid has made him one of the most successful investors of all-time. His approach to wealth building has inspired many 21-year-old investors to follow in his footsteps.

Warren Buffett’s Advice for Building Long-Term Wealth

Warren Buffett is a great example of how to build long-term wealth. His advice for achieving this goal is to invest in companies with a strong competitive advantage and focus on the long-term potential of the business. He also advises to save money for investment, diversify investments, and stay away from drugs, gambling, and other risky activities. The main takeaway from Buffett’s advice is to think long-term and focus on the fundamentals of investing. This means doing your research and making sure you are investing in companies that have the potential to grow. Finally, never forget to save money and invest wisely!

GIPHY App Key not set. Please check settings