Cryptocurrency can be a great way to help you with tax planning, but it can be difficult to know where to start. In this article, you’ll learn how to use cryptocurrency to plan your taxes and make sure you’re taking advantage of all the benefits it has to offer. We’ll cover topics such as calculating your gains and losses, understanding the tax implications of cryptocurrency, and exploring ways to minimize your tax burden. With the right approach, cryptocurrency can be a powerful tool for tax planning.

Research tax implications of crypto.

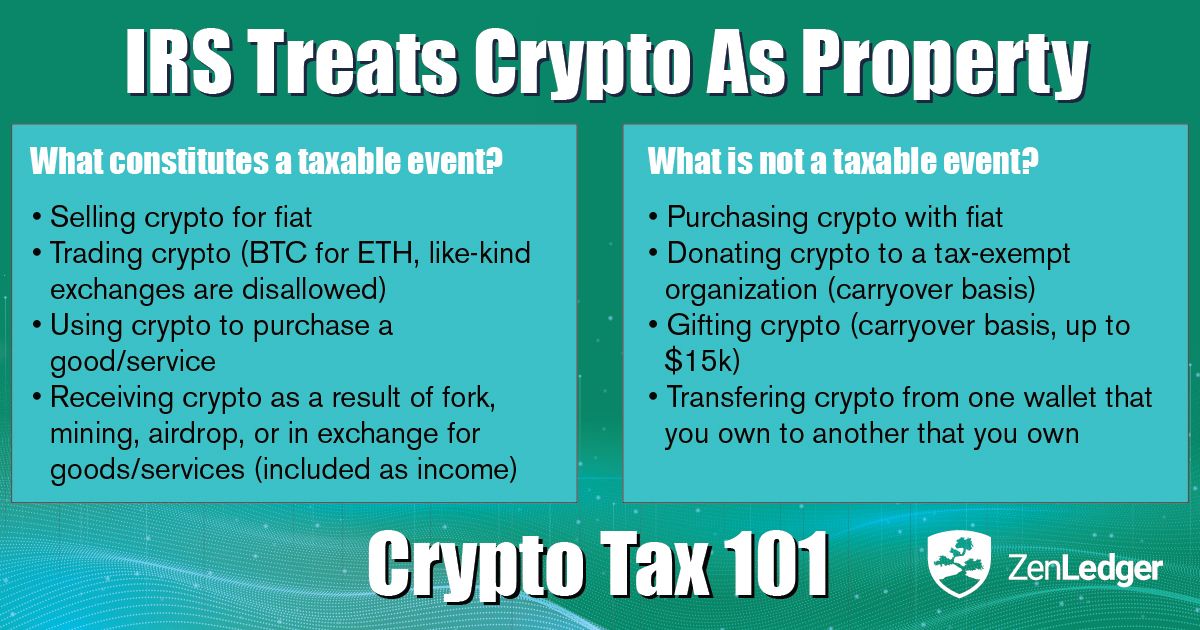

Researching the tax implications of cryptocurrency is an important step when planning your taxes. It is important to understand the legal requirements of your country and any capital gains or losses that may be incurred.

Consult with tax professional.

When it comes to tax planning with cryptocurrency, it is important to consult with a professional tax advisor to ensure that all of your transactions are properly reported. Doing so will help you stay compliant with the IRS and avoid any unwanted penalties.

Create cryptocurrency wallet.

Creating a cryptocurrency wallet is essential for tax planning. It allows you to securely store and manage your digital assets, as well as monitor transactions and track capital gains tax liabilities.

Buy crypto with fiat currency.

When it comes to tax planning, buying crypto with fiat currency is an easy and efficient way to invest in digital assets. This method offers a secure and reliable way to invest in cryptocurrency and can be used to achieve your tax planning goals.

Track transactions & gains/losses.

Tracking your cryptocurrency transactions and gains/losses is key when it comes to tax planning. Keeping accurate records of your investments is essential to ensure you’re paying the right amount of taxes. Make sure to keep track of when and how much you bought, sold, or exchanged cryptocurrency.

File taxes with crypto gains.

When filing taxes with crypto gains, it’s important to understand the taxation process and the applicable laws. Be sure to consult a qualified financial advisor or tax professional to ensure that you’re following all laws and filing correctly.

GIPHY App Key not set. Please check settings